As time goes by technologies change our lives more and more. Nowadays many traders can make their trading process easier and more straightforward with the help of the embraced technologies. Technologies first and foremost made it easy to access the Forex market from any location. You no longer need a computer in order to trade.

As a result, traders can now check the market anytime they want using their smartphones or tablets, which makes trading more enjoyable from the get-go. Back in the day, this kind of freedom was unimaginable.

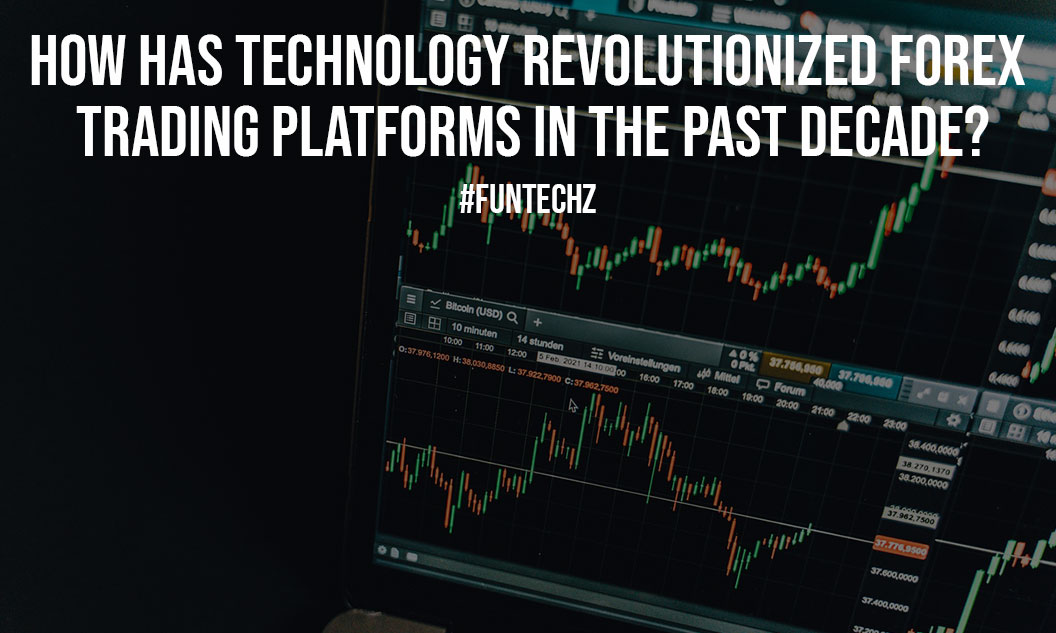

When it comes to trading Forex, one of the main things to consider is a trading platform – a software that provides traders with a myriad of services to make the trading process easier. Over time, even trading platforms became more sophisticated for investors, thanks to technological advancements.

In this article, we’ll mainly focus on how the technologies have revolutionized Forex trading.

The Importance Of Trading Platforms

As we already stated, when an investor enters the Forex market one of the first steps is to choose the right trading platform. In most cases trading platforms are offered by Forex brokers, however, you can choose software, which will allow you to conduct your trading process.

It should be stated that nowadays trading platforms furnish traders with dozens of useful services. This is because of technological advancements, which lead the companies to make their services more appealing to customers.

For example, while choosing a trading platform, you can find that there are several charts, tools, and indicators. All of these help you to forecast future price changes in the Forex market and find in which direction a certain currency or currency pair will go. If you are an investor who prefers technical analysis, a trading platform with a myriad of technical indicators may be heaven for you.

Technical indicators that are intertwined with backtesting MetaTrader4 aid Forex investors to define the volatility, volume, trends, and generating trading strategies. These will help investors to decide where to invest their money.

Nowadays there are several trading platforms in the industry that can benefit from technological advancements. Some of the most popular among others are MT4 and MT5. These trading platforms are prominent because of their user-friendly interface. When you download both of these platforms you can easily navigate on the screen and find the things you are looking for.

In the case of MT4, the number of technical indicators is defined at 30, while those who use the MT5 trading platform can benefit from 38 technical indicators.

In addition to that, for those who want to see how Forex trading works at a certain moment, platforms provide investors with an opportunity to look at charts and graphic objects. All of these visualizations aid traders in easily perceiving the market condition and the way it is going to develop.

Apart from the above-mentioned benefits, these platforms allow traders to start trading with algorithms and make the trading process automated. As a result, you will save your time and energy, while making money.

Even though some benefits can be taken from the trading platforms, nothing is perfect in this world. These platforms have their disadvantages as well. The fact that MT4 traders must configure the trading platform to fit their tastes is maybe the biggest negative of all. They must have some programming experience to achieve this.

Furthermore, the MT4 support system is insufficient for the majority of traders. This platform’s customer service is one of its weaker points. This may come as a major disappointment to both new and experienced traders. Organizations are more likely to benefit from MT4 than individuals.

Most liquidity providers provide hedging, therefore this is MT5’s biggest flaw: no hedging. As a result, spreads are projected to rise. When it comes to developing a sound risk management strategy, there may be some room for improvement. Because MQL 4 on the MT4 platform does not support the new version, all technical indicators and expert advisors must be rewritten in MQL 5.

Also Read: Why Must FX Traders Manage Their Emotions Well?

Tech-Driven Solutions In Forex

Nowadays there are many solutions in the Forex market that are tech-driven. All of these have one main goal – to make Forex trading more efficient. Simplified trading tools enabled by technological advancements have made Forex trade more accessible. These tools are meant to help traders maximize their strategies.

The simplicity of conducting business on the exchange market has been increased by the use of online technologies. Some software nowadays may be beneficial for traders who want to speculate on the market prices. While some may be meant for those who want to make their trading less risky.

One of the biggest advancements in the Forex market is the invention of EA. EA, also known as an expert advisor, is an AI-generated program that can be used on a trading platform.

The main idea of the EA is that it allows traders to automate the trading process. The one thing you should do when you use EA is to indicate specific orders manually. After EA sees that the market situation meets your criterion it will automatically start or stop the trading process.

Also Read: How to Use Currency Strength Meter?

What Does The Future Hold

As mentioned, technologies made it easy to trade Nowadays traders can find a plethora of tools, charts, and AI-generated EAs on trading platforms to make their trading process more efficient. Even though there are many advantages of using technologies in Forex trading, they have some disadvantages too.

For example, AI-driven tools may not react rationally to the market situation or make some mistakes that may lead you to lose money. As time goes by and technologies become more advanced, we hope that the disadvantages of technologies in the market will be minimized.

+ There are no comments

Add yours